Kurse werden geladen...

Prognose

Für dieses Unternehmen liegen uns keine Analysten-Daten vor.

Scoring-Modelle

Für dieses Unternehmen liegen uns bisher keine Scoring-Modelle vor.

News

Polarean inks US sales deal to boost lung imaging product reach

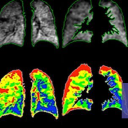

Polarean Imaging PLC (AIM:POLX, OTC:PLLWF) has signed a commercial agreement with Ascend Imaging, a US-based medical technology distributor, as part of efforts to expand sales of its lung imaging products in the United States. The UK-listed company, which develops specialist magnetic resonance imaging (MRI) technology using hyperpolarised xenon gas, said Ascend would act as an independent sales representative in four US states. The agreement is non-exclusive, meaning Polarean is free to enter into similar arrangements elsewhere. Ascend, which focuses on imaging and radiology solutions, will help identify new customers, support contract negotiations and promote Polarean's products, including its xenon-based MRI platform. The deal is intended to strengthen the company’s reach in key US markets without significantly increasing its internal salesforce. "This partnership enhances our reach in key US regions while maintaining operational efficiency, and we expect it to support meaningful commercial momentum in the second half of 2025 and beyond," Alan Huang, Polarean's vice president of sales. The company's imaging technology is designed to provide clearer and more detailed pictures of lung function than conventional scans. It is primarily aimed at diagnosing and monitoring respiratory conditions, such as chronic obstructive pulmonary disease and asthma, by allowing clinicians to see how air moves through the lungs in real time. The price of gold dropped 1.2% to a two-week lows below $3,320 after Israel and Iran agreed a ceasefire, following 12 days of fighting. Gold has fallen around 2% over the past week, after gaining from safe haven demand in the past week amid an escalation of hostilities and missile strikes, culminating with US intervention in the form of 'bunker buster' bombs dropped on Iran's nuclear facilities over the weekend. US President Donald Trump revealed in a post at just after 11pm London time that "it has been fully agreed by and between Israel and Iran that there will be a complete and total ceasefire" and that once final military activities had been completed in the subsequent few hours "the war will be considered ended". Israel's PM Benjamin Netanyahu confirmed the truce, with Iran’s foreign minister saying that "we have no intention to continue our response" provided that Israel stops its aggression and that a final decision on cessation of military operations "will be made later". The news also sent oil prices tumbling and a retreat for the US dollar. Richard Hunter, head of markets at Interactive Investor, says: "The pronouncement of a ceasefire between Israel and Iran and the lack of meaningful response from the latter to the US strikes over the weekend have lifted investor spirits and removed a plank of uncertainty. "The news gives fresh impetus to a risk-on approach, which has lifted shares across most developed markets, while also weighing on the gold price as investors switched their attention elsewhere."» Mehr auf proactiveinvestors.com

Polarean shares rise 6% on new US sales deal; broker applauds tie-up

Shares in Polarean Imaging PLC (AIM:POLX, OTC:PLLWF) rose 6% after the company announced a new commercial partnership with Ascend Imaging to boost US sales of its xenon-based MRI technology. The agreement, covering four states, allows Ascend to act as an independent sales representative, helping expand Polarean's footprint without growing its internal team.» Mehr auf proactiveinvestors.co.uk

US recession risk: Is the UK about to catch a cold?

There’s a reason the old cliché about America sneezing still gets wheeled out: it holds up. A new note from UBS flags that recession risks in the United States are quietly ticking higher again, and while nothing’s broken yet, the cracks are starting to show. UBS tracks three main recession indicators: real-world data, credit conditions and the shape of the US yield curve. And all of them are moving in the same direction. Not alarmingly so, but enough to suggest the so-called “soft landing” might not be the final word on the story. Real-world Let’s start with the real economy. UBS’s preferred tracker is built entirely from hard data: production, employment, capital spending, housing, income and consumption. Not a PMI or sentiment survey in sight. This model had flagged trouble back in 2022, only to reverse course in late 2023 as the economy stabilised. But that recovery has since fizzled out. April data, in particular, showed broad-based weakness across all the usual suspects. As a result, UBS now pegs the US recession probability from this model at 46%, up a chunky 12 percentage points in a single month. Troublesome bond market Next up is the yield curve, the time-honoured market signal where investors look at the gap between short- and long-dated Treasury yields. After two years flashing red, that warning light had dimmed. But now it’s glowing again, albeit faintly. According to UBS, the yield curve is currently implying a recession probability of 18%. That’s a far cry from the extremes of last year, but still a notable uptick. Then there’s credit. UBS’s credit-based model, which looks at financial ratios and lending conditions, didn’t fall into the same trap as the yield curve during the false alarm of 2022–24. It held steady. But even that has now started to shift. The model has climbed to a 48 per cent probability—the highest level since the pandemic. Don't press the panic button...yet Put it all together and UBS’s composite gauge puts the US recession risk at 37 per cent. That’s up from 26 per cent in December and, crucially, closing in on the kind of levels that have historically preceded actual downturns. To be clear, no one at UBS is calling a recession yet. The team stresses that the economy started this year on “okay footing”, but warns that “data deterioration could bring back discussion of recession risks”. What’s more, a lot of these shifts happened before the full impact of Donald Trump’s tariffs is likely to be felt. If those start to bite, the probability numbers could push higher still. Still the world engine for demand For those watching from this side of the Atlantic, the message is pretty simple. The US consumer is still the engine of global demand. If they do start to retrench (or if businesses start scaling back investment) there’s little chance the rest of the developed world comes out unscathed. For now, the lights are flashing amber. But it’s worth keeping a close eye on May and June’s data. If the slowdown starts to look more entrenched, expect the market narrative to shift fast, from soft landing to something a lot bumpier. Polarean Imaging PLC (AIM:POLX, OTC:PLLWF) shares rose 7% in afternoon trading after the company received US regulatory approval to expand the use of its lung imaging agent, XENOVIEW, to children as young as six. The decision by the Food and Drug Administration lowers the age threshold from 12, potentially opening access to around one million additional patients. XENOVIEW, used in MRI scans to measure lung ventilation without radiation, will now be available for younger patients with chronic respiratory conditions. Polarean will also roll out new dose delivery bags tailored to paediatric use, along with updated equipment to ensure accurate gas measurements for smaller lungs. The company said the move marks a significant step in broadening access to advanced lung imaging, while also improving the technology’s appeal to hospitals. A targeted launch of the paediatric system will begin later this year, starting with Cincinnati Children’s Hospital. The stock rose 0.085p to 1.36p.» Mehr auf proactiveinvestors.com

Historische Dividenden

Alle Dividenden KennzahlenUnternehmenszahlen

| (EUR) | Juni 2024 | |

|---|---|---|

| Umsatz | 521,63k | - |

| Bruttoeinkommen | 271,56k | - |

| Nettoeinkommen | −1,87 Mio | - |

| EBITDA | −1,66 Mio | - |

Fundamentaldaten

| Metrik | Wert |

|---|---|

Marktkapitalisierung | 11,33 Mio€ |

Anzahl Aktien | 1,21 Mrd |

52 Wochen-Hoch/Tief | 0,0285€ - 0,00853€ |

| Dividenden | Nein |

Beta | -0,04 |

KGV (PE Ratio) | −0,42 |

KGWV (PEG Ratio) | 0,00 |

KBV (PB Ratio) | 0,60 |

KUV (PS Ratio) | 26,93 |

Unternehmensprofil

Polarean Imaging plc ist ein Kombinationsunternehmen für medizinische Arzneimittel und Geräte, das den Markt für medizinische Bildgebung in den Vereinigten Staaten, Kanada, Deutschland und dem Vereinigten Königreich bedient. Das Unternehmen befasst sich mit der Entwicklung und Vermarktung von Gaspolarisationsgeräten und Zusatzinstrumenten. Es entwickelt Geräte, mit denen bestehende Magnetresonanztomographie-Systeme (MRT) ein Niveau pulmonaler funktioneller Bildgebung erreichen können, und spezialisiert sich auf die Verwendung von hyperpolarisiertem Xenon-Gas (129Xe) als Bildgebungsmittel zur regionalen Visualisierung von Ventilation und Gasaustausch in den kleinsten Atemwegen der Lunge, der Gewebeschranke zwischen der Lunge und dem Blutkreislauf und im Lungengefäßsystem; ein neuartiger Diagnoseansatz. Das Unternehmen ist auch an der Entwicklung und Herstellung von MRT-Radiofrequenzspulen beteiligt, die für die Darstellung von 129Xe im MRT-System erforderlich sind. Polarean Imaging plc wurde im Jahr 2016 gegründet und hat seinen Sitz in Durham, North Carolina.

| Name | POLAREAN IMAG.LS-,00037 |

| CEO | Dr. Christopher Richard Von Jako Ph.D. |

| Sitz | London, nc USA |

| Website | |

| Börsengang | |

| Mitarbeiter | 29 |

Ticker Symbole

| Börse | Symbol |

|---|---|

London Stock Exchange | POLX.L |

Pnk | PLLWF |

Frankfurt | 8ZF.F |

London | POLX.L |

München | 8ZF.MU |

Assets entdecken

Shareholder von POLAREAN IMAG.LS-,00037 investieren auch in folgende Assets